What’s a great Jumbo Financing?

Jumbo funds otherwise mortgage loans is actually, while the identity means, larger than mediocre money. He is available for higher income those who are interested property that will be over the compliant restrictions place of the Federal Homes Resource Expert (FHFA). If you find yourself looking for a property which is larger than lifestyle, needed a good jumbo financial. In those larger house (and larger fund), there is every piece of information you will need to make the best in House.Financing. Continue reading into the information or get in touch with the house money benefits now for the fresh (big) footnotes.

Jumbo Mortgage Concepts

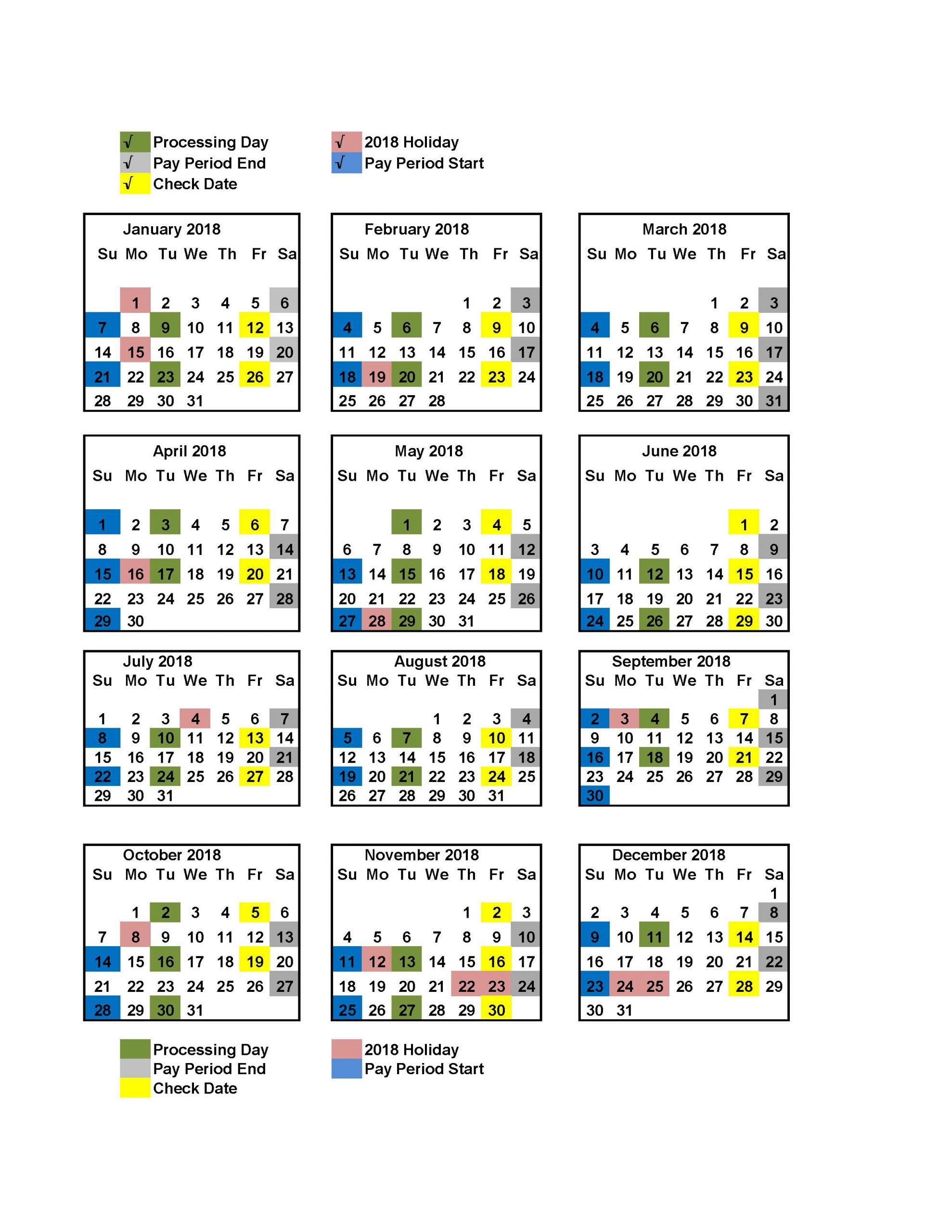

Jumbo mortgage loans occurs should you want to score a mortgage appreciated at the more than Federal national mortgage association or Freddie Mac will, inside the an effective conscious, purchase from a bank. For 2018, which is at the very least $453,one hundred across all the country, or more in order to $721,050 while you are staying in a top pricing urban area for example Hawaii. Since Fannie and you will Freddie have cleaned its give ones astounding finance, they might be called non-conforming, as opposed to the Fannie- and Freddie-beloved compliant finance.

These types of notes are great for all sorts of things, away from number 1 belongings to help you capital properties or second homes, but all this comes with a massive dated bag off caveats. They are certainly not an easy task to qualify for, and in comparison to just what some will get state, they actually do require a significant investment by you. At all, just what lender really wants to get so many buck house back into property foreclosure? The chance was real, so your financial desires to make sure that you might be because the significant because they are about your deciding to make the money.

What exactly are Jumbo Mortgage Conditions Such as for example?

Despite the fact that are deemed riskier than simply antique funds and get stricter degree requirements , jumbo money dont necessarily provides large costs. The lower administrative costs and you will organization worth of jumbo financing applicants has already established the effect of developing the new words more desirable. Here is what Jumbo mortgage conditions are such :

Off money used to be all the way to 29% http://availableloan.net/installment-loans-wa/clearview of one’s mortgage but may become less so you’re able to as little as 5% oftentimes. Observe that the new deposit affects the interest rate you’ll spend, the lower the down payment the better the pace and you can vice versa, therefore mind the manner in which you negotiate that it.

As a result of the already high monthly payments some lenders are willing to absorb the non-public financial insurance premium even if the down commission are less than 20%

Interest rates having jumbo loans was previously greater than compliant fund, but have has just equaled and regularly overcome her or him

Usually Jumbo financing are particularly more attractive given that highest money individuals are easier to perform, provides a good credit score and most importantly are an audience to own almost every other financially rewarding financial products including wide range government.

The loan terminology can notably cover anything from financial in order to lender. The team home.funds is wanting to help you to get an informed income for the the marketplace.

Jumbo Financial Calculator

If you are considering bringing a jumbo home loan, and wish to guess the prospective monthly installments, is actually our jumbo mortgage calculator. By the inputting the loan matter and interest rate, and you can function the borrowed funds system otherwise identity length, you will find what your monthly installments will look for example more than day. If you are the calculator will not estimate settlement costs (and lots of most other fees), will still be a powerful way to find out if a beneficial jumbo household loan can help you have the household you dream about.

As the jumbo loans have variable-price and you may fixed-rates variations, all of our jumbo home loan calculator helps you explore all of these types of options. And, if you are considering refinancing your jumbo financing, all of our calculator may also give some much-requisite sense.